At the heart of Grand River Rubber & Plastics beats a legacy that spans generations. Meet James Leonard, Bayonet Operator for the last 21 years, and his two sons, Jesse, Controls Engineer, and Joey, Bayonet Operator, a trio bound not only by blood but by their shared dedication to excellence in manufacturing.

Grand River Rubber & Plastics Blog

Customer Spotlight: Not Just Satisfied, VERY Satisfied

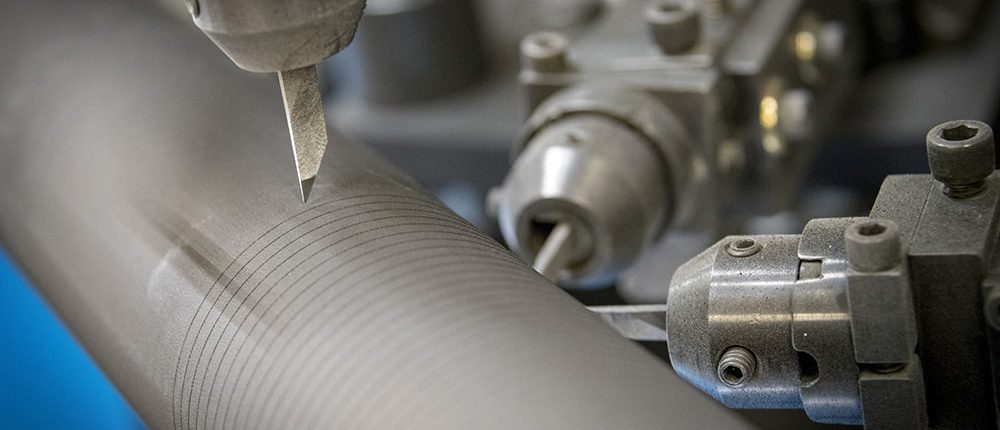

Grand River Rubber & Plastics Acquires Lathe Cut Gasket and Seal Division of ASC Engineered Solutions, LLC. (Ashtabula Rubber Co.)

Topics: Lathe Cut Gaskets, die cut gaskets, seals

Grand River Rubber and Plastics Receives ISO 9001:2015 Recertification

Topics: ISO 9001 certification

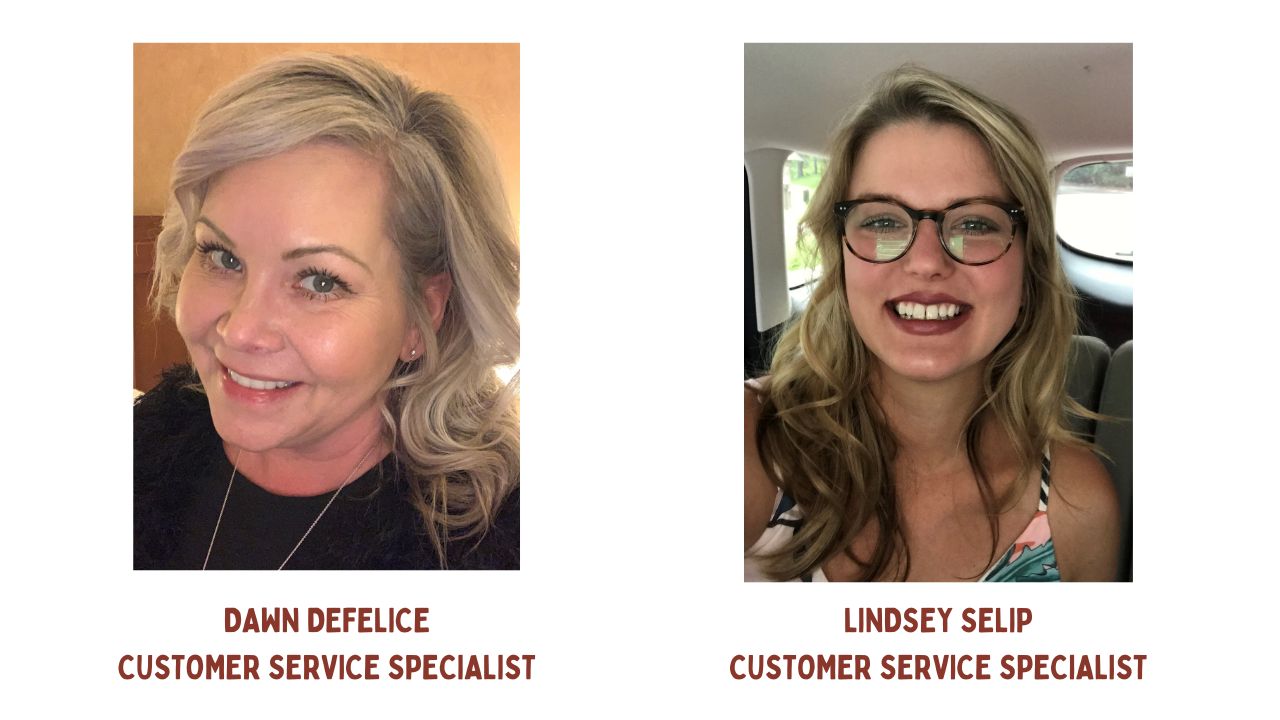

Meet Dawn DeFelice and Lindsey Selip - Customer Service Spotlight

Topics: employee ownership, sweeper belts, Work at Grand River Rubber

Meet Jason Bernardo Jr. and Sr., Grand River Rubber’s Father-Son Duo

Topics: employee ownership, sweeper belts, Work at Grand River Rubber

Meet Vicki Ellsworth, Customer Service Representative

When you start asking questions of Grand River Rubber & Plastics employees, a common theme emerges: there’s no such thing as a ‘typical’ workday, and they seem to like it that way.

Topics: Lathe Cut Gaskets, employee ownership, Work at Grand River Rubber

Jim Hlebovy joined Grand River Rubber & Plastics in 2018 as a Quality Engineer, then the position evolved into a Process Engineer. He has worked in both Quality and Engineering. Jim said that as a child, he wanted to be a mechanic or someone who worked on equipment to fix it.

Topics: Lathe Cut Gaskets, employee ownership, Work at Grand River Rubber

Topics: Lathe Cut Gaskets, die cut gaskets, sweeper belts, Manufacturingjobs